Learning about the ins and outs of qualifying for surety bonds as a construction contractor may sound like a dry course of study, but contractors may find those expectations defied when they tune into the new Contractor Bonding Education and Mentoring Program (www.contractorbondinged.org) for construction firms. It’s a sleek, engaging, and streamlined production of The Surety & Fidelity Association of America (SFAA) and the NASBP. It’s also free.

The online, on-demand course starts with an introduction from professionals, including those representing the views of minority and women-owned contractors, who speak about the real-life necessities that bring surety bonds into business lives. “My name is Carlos Manning. I’m a disabled veteran who owns a small paving company. We focus on residential and commercial paving such as driveways and parking lots,” says one contractor persona by way of introduction. The comprehensive program includes 9 learning modules, taking contractors from A to Z through the surety bond qualification process in about five hours. Contractors who are in the market for transactional bonds can use Modules 1 through 3 and finish in less than two hours.

“Over the years NASBP and SFAA have worked to develop a number of resources to educate small and minority-owned contractors on bonding. NASBP’s SuretyLearn for Contractors website included articles, presentations, and an online narrative course, but none of those resources is like the state-of-the-art online educational experience now developed,” remarked NASBP CEO Mark McCallum. SFAA’s previous education program, called the Model Contractor Development Program, provided information on the fundamentals of surety but also covered other key topics related to business operations. The program required consecutive weeks of contractors’ time and participation via in-person instruction on weeknights. “The new program was designed to ease that burden with modules now available online that can be taken on demand at the learner’s pace and that focus on surety bonding,” said Julie Alleyne, Vice President, Policy and General Counsel for SFAA.

“Producers and underwriters really are the experts on surety, so it made sense to engage them when creating the new Contractor Bonding Education and Mentoring Program,” said Alleyne. “By utilizing the expertise of our members, we were able to create a definitive course on surety bonds, while also helping construction businesses understand the resources available to them and the key parties who can help them when applying for a bond. The goal is to help these companies broaden their access to construction project opportunities, which require surety bonding and gain a competitive edge in the market.”

SFAA and NASBP staff, together with volunteer SFAA underwriters and NASBP bond producers, teamed up as subject matter experts with eLearning experts Blue Streak Learning. The result is a snappy course aimed at attracting small, emerging, disadvantaged, and minority-owned contractors, though any contractor interested in bonding can benefit from taking the course.

“The new platform is designed to engage participants through videos, exercises, and self-assessments,” noted McCallum. “The development of this unique, 24/7-available education resource program will further extend the reach of the surety industry to those businesses needing basic surety bonding information, especially to small and disadvantaged businesses, which often are unfamiliar with the process to qualify for bonds.”

“After completion of one of the course pathways, the contractor participant can decide to enter a mentoring process for assistance in crafting an action plan for that construction business to achieve bonding,” McCallum explained.

In the mentoring program, contractors are matched with a NASBP and a SFAA member to help them apply what they have learned to their own businesses.

Jill K. Tucker, CIC/CRM, is a Surety Bond Specialist at the NASBP member firm Insurance Underwriters, Ltd. in New Orleans and is one of several NASBP bond producers who served as a subject matter expert in developing the curriculum. “The curriculum was intentionally written using down-to-earth language, avoiding the jargon that can creep into bonding talk,” Tucker said. “The bonding curriculum can prevent misunderstandings and surprises if contractors have taken the course before their surety interview,” she added.

David Pesce, the New York City based Head of Surety for Munich Re Specialty Insurance, was an important part of the project team and served as a subject matter expert who had a wealth of industry experience. Pesce, whose company is a member of SFAA and an affiliate of NASBP, said the bonding curriculum is both more customizable and more in-depth than the previous learning tool. He said designers wanted to ensure that contractors could easily tailor the education to their own needs.

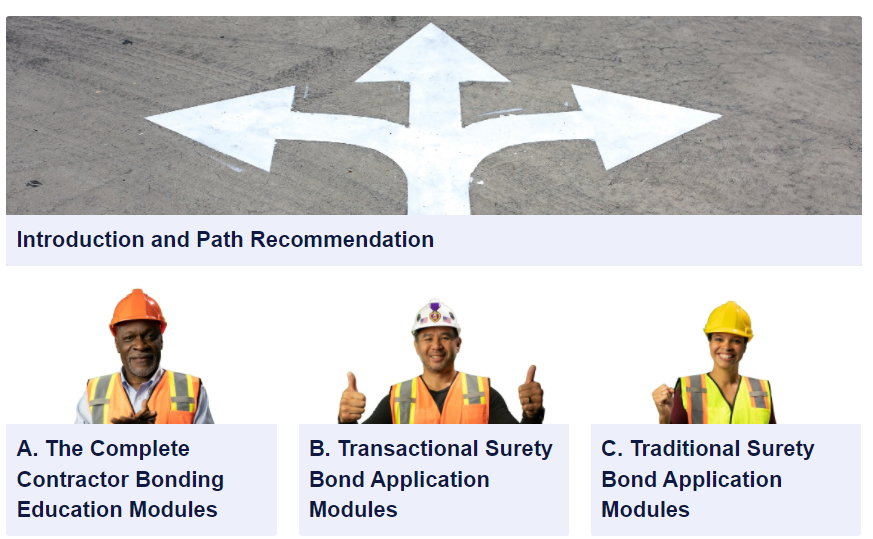

To that end, the curriculum includes three pathways: one for contractors who need transactional bonding only (Modules 1 to 3), another for those who require an on-going bonding relationship (Modules 4 to 9), and a third to the complete set (Modules 1 to 9). “They’ll have far more clarity of what’s expected, who’s involved, and how the process goes for their particular need,” Pesce said.

The different paths reflect the fact that the curriculum is aimed at contractors who find themselves on a continuum within the construction industry.

“Every contractor’s expertise lands somewhere on the spectrum between a trade to business skills,” explained Greg Horne, AVP Contract Surety for Liberty Mutual Surety in King of Prussia, Pennsylvania, and Chair of the SFAA Contract Bonds Advisory Committee. Liberty Mutual Surety is an SFAA member and a NASBP affiliate surety company.

Like others who helped create the curriculum, Horne said it is meant to show small contractors that bonds are not another onerous requirement but rather an opportunity for business growth.

“Contractors who gain pre-approval for bonding can bid on many government projects, may qualify for better bank loan terms, and have a leg up when responding to RFPs,” explained Horne.

Horne also noted that surety bonding pre-qualification can have public benefits. He pointed to a failed contract for a $360 million Harrisburg, Pennsylvania, incinerator project and another for a $156 million post-Hurricane Maria food distribution project in Puerto Rico. Horne said underwriters and bond producers could have spotted the weaknesses of these contractors before governments squandered taxpayer money in both of these cases.

NASBP member Chris Downey, President of the NASBP member firm Downey & Company in Albuquerque, New Mexico, and Chair of the NASBP Small & Emerging Business Committee, said the new and improved education program will prime contractors to ask the right questions when they sit down with a bond producer.

“It’s going to encourage them to want to work the program and to engage the surety,” Downey said. “The headline here is this is the modern surety education program. We’ve encapsulated the path to modern-day surety and presented it in a way that I believe is very user friendly.”

Surety Bond Quarterly Professionals in Surety Bonding

Surety Bond Quarterly Professionals in Surety Bonding