Attendees at the 2023 NASBP Annual Meeting and Expo this spring had a unique opportunity to catch a glimpse into the future of the surety industry. The Institute’s RiskStream Collaborative (RSC), partnering with surety system solution providers attending the meeting, offered a state-of-the-art demonstration of a technology that enables digital bonds to be verified and authenticated on a blockchain network.

The RSC’s Surety Advisory Committee has been exploring ways to use blockchain technology to streamline and digitize many aspects of surety workflow processes since its formation in 2020 (see graphics below). The RSC is the risk management and insurance industry’s largest enterprise-level blockchain consortium.

RSC, with technical solution provider Kaleido, created Canopy, a multiplatform enterprise blockchain framework. Working through the systems of their choice, surety industry stakeholders will be able to execute and authenticate digital bonds through this network platform. They will also be able to verify paper bonds are registered in the underwriting company’s system of record. Canopy will provide a single point of truth for all these transactions.

“The end goal is to advance the industry away from pen and paper and to provide a common global network that offers a blockchain-backed proof of a digitally executed bond,” said Sandy Hampel, RSC’s Director of Products.

The RSC Surety Advisory Committee originally focused on developing the digital process for the power of attorney (POA) and successfully completed that proof of concept (POC) in early 2022. “In that phase, we demonstrated and provided Canopy’s robust technology stack and showed how the application can streamline the sharing and verification of data among network participants,” said Hampel.

The End Game—Replacing Paper with Digital Bonds

Even before the POA proof of concept was complete, RiskStream decided to begin work on digital authentication and verification for surety bonds, given the tremendous support and participation in the surety initiative globally.

“Having one system in place worldwide can expedite the whole process for everyone,” said RSC Surety Advisory Committee Chair, Greg Davenport, who is a Senior Vice President at NASBP Affiliate Liberty Mutual Surety. “If the surety industry in each country were to develop its own blockchain platform, the result could be a lot of unnecessary duplication of efforts and additional costs.

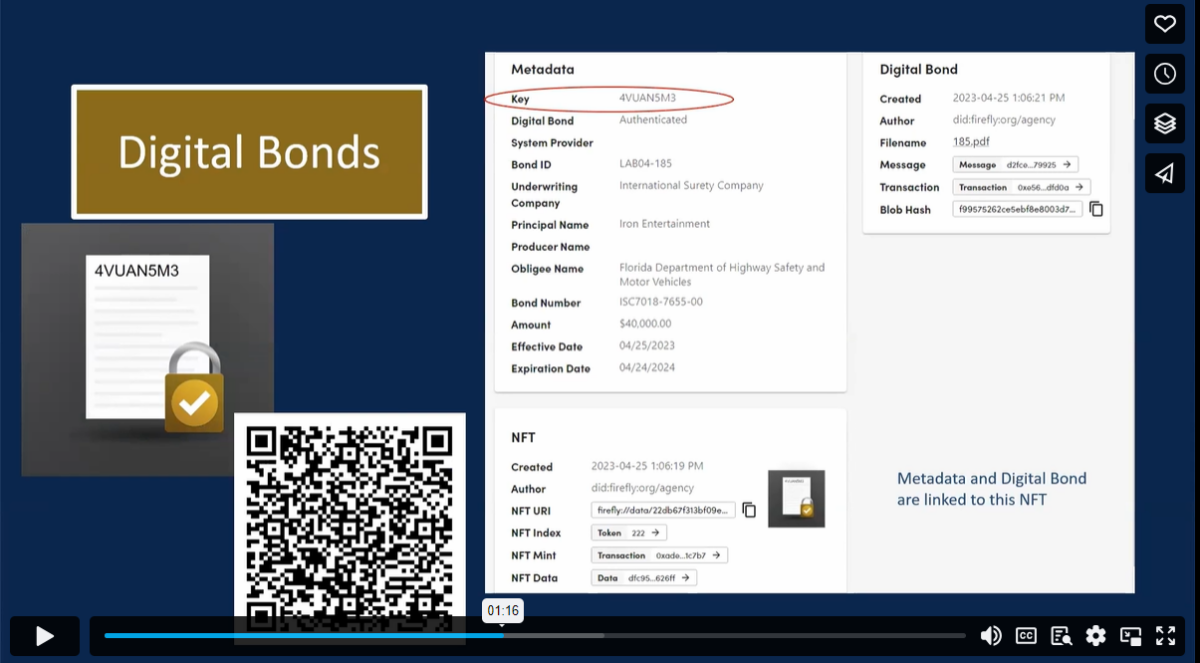

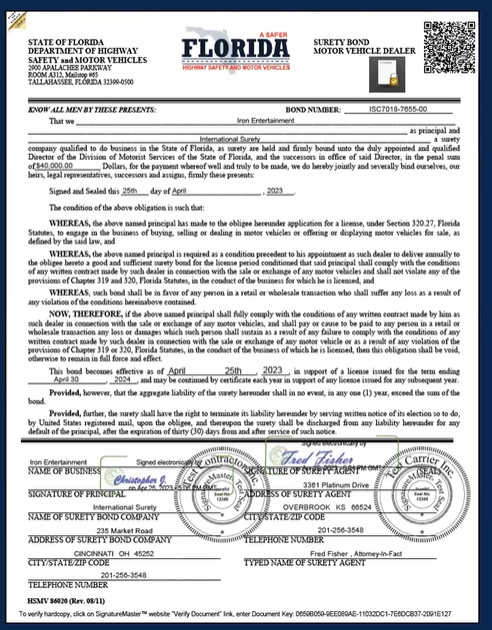

“Accelerating the authentication/verification piece enabled core surety system providers like BondPro, Surety 2000, Tinubu, and Xenex to prove the concept using APIs (application programming interfaces) to connect their systems to the Canopy network and the blockchain in advance of the NASBP Annual Meeting,” he added. “The demonstration at the NASBP Meeting showed how the Canopy platform would verify bond obligations registered in a surety’s system of record. For digital bonds, participating surety system providers demonstrated that digitally executed bonds provide an additional layer of authentication compared to paper bonds. A digitally signed bond was posted on the Canopy network and minted as a non-fungible token (NFT). The NFT is a unique identifier; a Canopy user can click on it to view the bond and its associated metadata to determine that the bond and the information are authentic.”

The second component that was demonstrated was a QR (quick response) code generated by Canopy and embedded on the bond form. “We were able to demonstrate, by scanning the QR code on the digital bond, that it had not been tampered with,” Davenport added. The NFT and the QR code always point to the immutable and decentralized record of the digital bond, dramatically increasing the level of trust.

QR codes can also be embedded onto paper bonds, for verification that the bond has been registered in the surety’s system of record.

Positive Reception

At the NASBP Meeting, the core surety system providers were able to execute a digital bond and then demonstrate that both the NFT and the QR codes associated with the bond would link into the Canopy platform. From there, meeting participants could see all the information about the bond that would allow them to verify and authenticate it.

The people who viewed the demonstration were generally positive about the potential for digital bonding, Hampel said. “The ability to save money on printing and mailing was well received. We estimated a digital bond costs one-third of what a paper bond costs to produce, sign, and deliver. The potential savings for the industry is projected to be millions of dollars annually. Some agents told us that they spend two to three times what we estimated on their overnight mailing costs alone.”

She said the POC presentation helped allay some agents’ and brokers’ fears about how digital bonding could impact their relationship with their clients. “After seeing the demonstration and understanding the solution, attendees could see their role and relationships will continue to be important. Implementing the technology and processes associated with blockchain will improve service, responsiveness, and profitability,” Hampel added.

Next Steps

With the successful POC demonstration, the RSC Surety Advisory Committee has identified a select few government agencies to initially review the work done with the POA and authentication/verification solutions and to provide feedback and suggestions for improvement. That process should be underway by the fall.

“We want to understand from the obligee’ s perspective what else we need to consider. Since ultimate acceptance of the solutions will be up to obligees, we want to be sure our solutions meet their needs,” said Davenport. “We’re confident many obligees and beneficiaries will welcome this opportunity since some have been accepting digital bonds and others have been asking the industry to provide this type of digital option for decades.”

After incorporating that feedback, the RSC and its Surety Advisory Committee will begin the process of building out the system. “To advance to a production-hardened state, additional bond data fields need to be defined; and the application must be hardened to assure scalability, security, and reliability as it moves from a test environment to a production environment,” said Hampel.

In addition, the Surety Advisory Committee will need to address funding the continuation of this work. “The creation of the Canopy platform was funded through The Institutes. The RSC and surety-related organizations that participated in the laboratory POC phase funded the two POCs. The RSC is working with its Surety Advisory Committee to develop funding models to build and run the surety blockchain solution globally,” said Davenport.

A New Way of Doing Business

Hampel said that blockchain technology holds promises for other surety processes as well. “RiskStream identified several opportunities for a network-based, data-sharing block chain technology that would benefit this industry, from underwriting to financials, payment, commission, and claims,” she explained.

But there’s one more hurdle that must be overcome before the move to a digital platform becomes a reality. The industry must be willing to embrace it. The technical solution for digital bonding that RSC has devised does not, on its own, transform the business processes that are required for the industry to fully adopt it. This will require the support of a broader ecosystem of carriers, brokers, and obligees/beneficiaries.

“Surety is the most conservative corner of one of the most conservative industries out there, which is insurance,” said NASBP Second Vice President Robert Coon, who is Vice President – Surety of NASBP Member Scott Insurance. “It’s very slow to adopt new technology, but I think, for us to stay relevant and to be able to serve our clients, we need to become more tech savvy.” The surety industry can either help guide the move to new digital technologies or somebody else will come in and disrupt the industry.

“The hardest thing to do will be to get people to move from that piece of paper to an intangible electronic document. But there’s a very good case for it,” he added. With the problems that the industry had during COVID, such as getting seals out of closed offices and finding the right people to physically sign documents, it has become very clear that changes are needed in the way that the industry does business.

Coon, former chair of NASBP’s Automation and Technology Committee, has been active in The RSC Surety Advisory Committee’s work for both the power of attorney and authentication/verification. “My hope is that we can get a broad-based coalition of sureties, agents, obligees, and principals to support this. I think everybody recognizes that we’ve got to get away from paper,” Coon said.

The RSC Surety Advisory Committee believes that can happen. “It may, however, still be a long process before digital bonds are accepted in every instance bonding globally,” said Davenport.

Davenport and Hampel shared their excitement about the RiskStream Collaborative’s recent achievements during an episode of the NASBP Let’s Get Surety—Let Me Hear Your Bonding Talk® Podcast.

Move to Digital Requires Widespread Collaboration

In 2020, leading organizations in the surety industry, including NASBP, the International Credit Insurance & Surety Association (ICISA), The Surety and Fidelity Association of America (SFAA), the Surety Association of Canada (SAC), and the Pan American Surety Association (PACA), came together to support The Institute’s RiskStream Collaborative’s Global Surety Blockchain Initiative. Their goal was to move the surety industry and its business processes into the digital age with the adoption of digital bonding.

(To learn about the RSC Surety Advisory Committee’s initial work, see NASBP’s 2022 article, Surety Industry Makes Progress in Reaching Goal of Digitized Bonding.)

Today, industry participation in the RiskStream Collaborative surety initiative is extensive. Nearly all major sureties, representing over 75% market share globally, are assisting in its work.

NASBP has been active in shaping this digital bonding initiative and in promoting it. “NASBP has used its vast array of communication tools to keep this initiative in the spotlight,” said Greg Davenport, a Senior Vice President at Liberty Mutual Surety and Chair of RSC’s Surety Advisory Committee. “We know we can count on NASBP and its members to help our industry get from concept to production and to promote adoption of the blockchain solution once it’s available.”

Surety Bond Quarterly Professionals in Surety Bonding

Surety Bond Quarterly Professionals in Surety Bonding